– By Michael Nagel

When reading the business news it is impossible to ignore the reports of the mammoth = growth and development of the Oil & Gas sectors of Western Canada. 2014 could be a milestone year with new pipelines, the game changing LNG (Liquefied Natural Gas) terminals and more investments in the Oil Sands. Decisions made will have huge impacts for workers, communities and the aviation industry.

Managing this activity has grown in complexity. Communities like Fort McMurray have not been able to accommodate the flood of of workers and smaller cities like Kitimat, may not want to. Balancing the sensitive social and economic issues with First Nations is also a huge factor. The aviation industry is key in providing solutions.

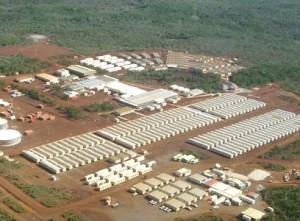

Mini-camp communities now feature facilities accommodating aircraft in the ~ 150-passenger class. In Alberta, there are more than 180 airports with International Civil Aviation Organization (ICAO) designation, many operated by the major Oil & Gas companies.

Skills shortages exist in Western Canada. Competition will escalate as provinces and companies compete for these resources. The “benefits” factor for workers beyond compensation becomes vitally important, like maximizing time off. Consequently, most workers now Fly in/Fly out. FIFO is the buzzword in most job advertisements sourcing technical and academic remote workers.

One of the latest Tar Sands operations to recently achieve “First Oil” in Alberta was Imperial Oil with their Kearl Project now producing ~110,000 BBL/D (barrel per day) with forecasts to mirror the production in phase 2 (Kearl Expansion). In this construction phase alone, Imperial has 5000 remote workers on site per day. At the nearby ConocoPhillips construction site, this is a similar work model.

Scheduled carriers like WestJet and Air Canada have identified the value by bypassing their own hubs to fly to oil & gas markets. The airlines recently announced direct flights from Toronto, Vancouver and Kelowna to Fort McMurray. While the evidence is not definitive, there are reportedly over 5,000 migrating workers just in Kelowna.

“In our charter models, we strive to transport workers as quickly as possible and therefore base a Boeing 737 aircraft in St. John’s, NL.” says Hart Mailandt, Director, Business Development of North Cariboo Air. This saves valuable time for travel, improves the worker’s family time and saves the customer money.

“Our research indicated that Oil & Gas clients wanted new aircraft that were more reliable, had lower noise and GHG (greenhouse gas) emissions, and could fly non-stop across Canada.” said Darcy Morgan, Chief Commercial Officer of ENERJET who launched the B737- 700 NG in 2008.

“Increasing the efficiency of all resources is key,” explains Mailandt, “time is money so our charter customers want to maximize time on tools.” Aviators must deliver workers on the job site as quickly as possible.

Established carriers such as Porter declared in 2013, they plan to enter Western Canada with the Bombardier Q400 and the CS 100 aircraft. Additionally, upstart carrier JETLINES also announced in 2013 that they plan to use a fleet of Airbus A319/320 to fly from Vancouver to several secondary markets.

The new business segment that is “traveling for work” has higher expectations. Oil & Gas customers that use guidelines such as OPG (Oil & Gas Producers) also expect best in class principles from aircraft technology, safety and comfort. In 2013, Sunwest Aviation christened their new facilities at Calgary International Airport. Clearly accommodating customer evolution, it features ~600 parking stalls, leather lounge seating, valet car service, robust check-in and fresh Starbucks coffee.

The airport in Fort McMurray adjusting to high passenger movement, has scheduled major improvements from runways to a new International Facility in June 2014. 2013 passenger counts soared to 1.2 million from 958,000 in the previous year.

The Northwest Regional Airport (Terrace/Kitimat) is also reacting to the development in the region. “The forecast of huge investments by Oil & Gas companies in the region and our passenger forecasts at 200 to 500 a day motivate us to get the airport ready.” remarks Carmen Hendry Airport Manager. In 2013, the airport handled 177,600 passengers, a 28% increase over 2012.

The constant state of improvement in the science of workforce logistics has helped manage the shortage of workers in mega projects around the country. Aviation, from environmental applications to providing affordable transportation, has also supported the principle of maintaining our fragile social fabric from First Nations lands to small communities across Canada.

In spite of the current global Oil & Gas price volatility there are still numerous large Exploration, Construction and Production projects in play. And even more projects in or nearing a stage of Front End Engineering Design (FEED) phase.

In spite of the current global Oil & Gas price volatility there are still numerous large Exploration, Construction and Production projects in play. And even more projects in or nearing a stage of Front End Engineering Design (FEED) phase. Global Oil and Gas exploration is increasing in new onshore and offshore locations with the goal to meet the insatiable appetites of worldwide energy markets. These new operations stretch the availability of the entire aviation supply chain including government operated Search and Rescue (SAR) as well as Aviation Emergency Medevac Services (EMS).

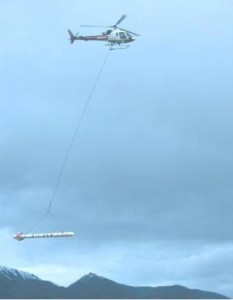

Global Oil and Gas exploration is increasing in new onshore and offshore locations with the goal to meet the insatiable appetites of worldwide energy markets. These new operations stretch the availability of the entire aviation supply chain including government operated Search and Rescue (SAR) as well as Aviation Emergency Medevac Services (EMS). In the past few years there have been great innovations in safety, training and technology and Canadian helicopter operators and manufacturers have been at the leading edge on numerous implementations and improvements.

In the past few years there have been great innovations in safety, training and technology and Canadian helicopter operators and manufacturers have been at the leading edge on numerous implementations and improvements.