Companies are facing financial challenges and shareholders/management are demanding, more than ever for IT opportunities to optimize their workforce logistics spend. Specific tools are emerging to help manage operations to ensure maximum profit. But, only a few propose an integrated software solution that book and track air travel, ground/marine transportation, camp/RIG lodging plus workforce scheduling. Logistics Managers should consider the following analysis and research points:

1 – Does the software platform correspond to your needs and your budget?

Figure out what you really need. This might seem obvious, but if you know what you want, ideally separated into a must-have list and a nice-to-have list, it will be much easier to figure out if any given solution fits your business needs.

2 – Does the workforce logistics software have an intuitive interface?

Resource companies must pick a service that is efficient and easy-to-navigate to increase employee’s satisfaction and performance. The solution must be web-based (in the cloud) with access to integrate every stakeholder of your operational processes such as contractors, travel agency & aviation providers.

3 – Does the workforce logistics software adapt to your reality?

Can the platform scale to follow your business growth or vision? Be sure your vendors can adapt from a small project (100 people) to large project (100,000 people). The last thing stakeholders wish to face is the need to re-evaluate and re invest in a new solution because of existing system shortfalls.

4 – Does the workforce logistics software enhance your operational processes or excellence?

You need to choose a solution that will integrate all parts of your workforce logistics to eliminate the burden of complex manual processes and improve project efficiency. Ask yourself.

- Does the software facilitate operations? Does it track and monitor critical issues?

- Does it allow performance reporting? How are updates and upgrades managed?

5 – Does the software include a strong local team and 24/7 services to support you?

Get the support you need when you need it. Pick an experienced company who will be able to guide you through the necessary adjustment towards operational optimization and cost savings. You want to able to count on an experienced and comprehensive team that will work with you long term.

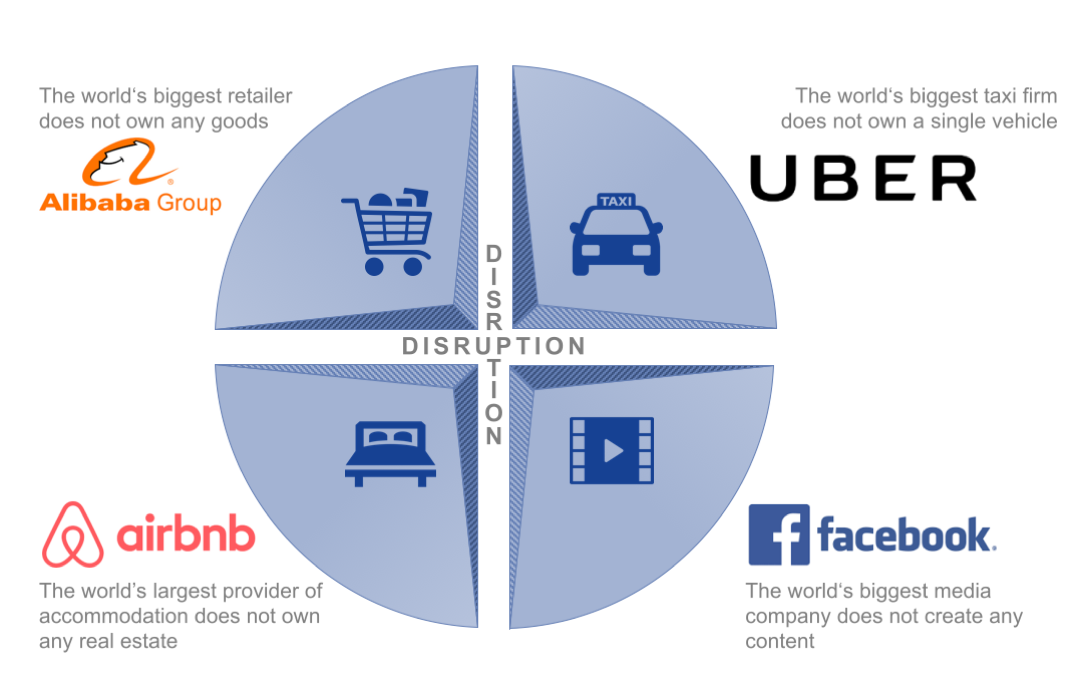

By definition, the Sharing Economy is a socio-economic ecosystem built around the sharing of human, physical and intellectual resources. It includes the shared creation, production, distribution, and consumption of goods and services by different people and organizations. It is no longer a fad or phenomenon but a reality in life and in business, especially in the RESOURCE sectors globally.

By definition, the Sharing Economy is a socio-economic ecosystem built around the sharing of human, physical and intellectual resources. It includes the shared creation, production, distribution, and consumption of goods and services by different people and organizations. It is no longer a fad or phenomenon but a reality in life and in business, especially in the RESOURCE sectors globally. Transport Canada has released five new recreational drone operation rules. The rules aim to enhance safety, and are effective immediately.

Transport Canada has released five new recreational drone operation rules. The rules aim to enhance safety, and are effective immediately. For those in the resource industry and supply chain, that may have missed this show, I am sure you have heard that it was very well attended by investors, mining companies and the supply trade from around the world. In fact, the attendance was over the 22,000 + mark. PDAC maintains its stellar position as the largest Mining Trade Show in the world.

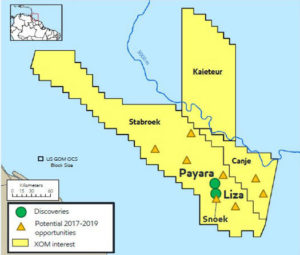

For those in the resource industry and supply chain, that may have missed this show, I am sure you have heard that it was very well attended by investors, mining companies and the supply trade from around the world. In fact, the attendance was over the 22,000 + mark. PDAC maintains its stellar position as the largest Mining Trade Show in the world. I was just in Guyana over a year ago (Aviation Consulting – Oil & Gas) during the drilling program. Helicopter Logistics including Search & Rescue handled by Bristow Helicopters with AW139’s.

I was just in Guyana over a year ago (Aviation Consulting – Oil & Gas) during the drilling program. Helicopter Logistics including Search & Rescue handled by Bristow Helicopters with AW139’s. However, the timing cannot be any better for the application of UAV or Drones in the Oil & Gas Industry. From the monitoring of pipeline right-of-way to inspecting a drill rig, the UAV would be undoubtedly an opportunity to reduce cost and operational risk. While most have cameras with downlink applications, some can now detect leaks (flare stack inspection to gas emissions) with specialty sensors.

However, the timing cannot be any better for the application of UAV or Drones in the Oil & Gas Industry. From the monitoring of pipeline right-of-way to inspecting a drill rig, the UAV would be undoubtedly an opportunity to reduce cost and operational risk. While most have cameras with downlink applications, some can now detect leaks (flare stack inspection to gas emissions) with specialty sensors. However, the slump in oil & gas has not been so favorable for aviation operations focused on this industry in workforce charter for both offshore & onshore. The reduced CAPEX and OPEX budgets have affected the demand for aviation services of both Helicopter and Fixed Wing. In particular, it has caused limited growth in onshore or offshore exploration and a curtailed expansion in production. On May 5th, CHC Helicopter, one of the largest offshore helicopter operators, filed for Chapter 11 Bankruptcy in the US. Recent news indicates the operator will go from 230 aircraft to 75!

However, the slump in oil & gas has not been so favorable for aviation operations focused on this industry in workforce charter for both offshore & onshore. The reduced CAPEX and OPEX budgets have affected the demand for aviation services of both Helicopter and Fixed Wing. In particular, it has caused limited growth in onshore or offshore exploration and a curtailed expansion in production. On May 5th, CHC Helicopter, one of the largest offshore helicopter operators, filed for Chapter 11 Bankruptcy in the US. Recent news indicates the operator will go from 230 aircraft to 75!